Introduction

Vietnam’s refreshment beverage market has been undergoing rapid growth and significant transformation in recent years. From a traditional market dominated by carbonated soft drinks and bottled teas, it is evolving into a diverse and dynamic sector driven by urbanization, rising health awareness, and changing consumer lifestyles. The Usage & Attitude (U&A) study conducted by InsightAsia from November 2024 to January 2025 across five major cities—Hanoi, Ho Chi Minh City, Da Nang, Can Tho, and Hai Phong—provides a comprehensive snapshot of the current market dynamics, consumer needs, preferences, and emerging trends shaping Vietnam’s beverage industry.

According to the report, the Vietnamese beverage market was valued at USD 5.2 billion in 2024 and is projected to grow to USD 5.8 billion by 2026, with a compound annual growth rate (CAGR) of 5.8%, which outpaces the overall beverage sector growth. This optimistic forecast signals not only an expansion in market size but also significant shifts in consumption patterns and product innovation to meet increasingly sophisticated consumer demands.

1. Leading Categories and Consumption Trends

Carbonated Soft Drinks (CSDs)

Despite growing health concerns, carbonated soft drinks remain the dominant category, with a weekly consumption rate of 75%. Global giants such as Coca-Cola and Pepsi continue to lead in brand awareness and usage, maintaining their stronghold in Vietnam’s beverage market. These drinks are popular in social gatherings and mealtimes, serving as refreshing and enjoyable accompaniments.

Ready-to-Drink (RTD) Tea and Coffee

RTD tea and coffee are fast-growing segments reflecting changing consumer lifestyles and preferences. RTD tea is consumed weekly by 68% of respondents, with Gen Z consumers showing especially high engagement at 78%. Meanwhile, RTD coffee boasts the fastest year-on-year growth at +18%, driven by innovation in flavors and packaging formats.

This growth is supported by the rising number of young professionals, urban dwellers, and middle-class consumers seeking convenient, quality beverage options. RTD coffee, in particular, taps into the growing coffee culture and demand for premium, on-the-go caffeine boosts.

Energy and Sports Drinks

Energy drinks remain more popular among men, with 58% weekly consumption. Sports and isotonic drinks are expanding beyond exercise-related consumption, increasingly used as daily hydration options by 52% of consumers. This indicates a trend toward functional beverages that provide not just refreshment but also performance and health benefits.

2. Consumption Occasions and Consumer Needs

Vietnamese consumers choose beverages primarily for social occasions (68%), mealtimes (52%), and on-the-go moments (48%). These contexts highlight the beverage’s role in social interaction, complementing food, and providing convenience during busy days.

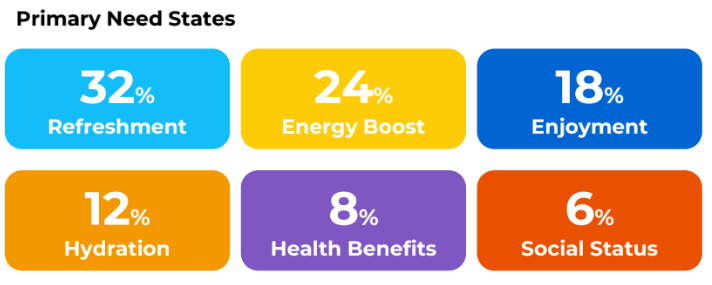

Key consumer needs driving purchases include refreshment (32%), energy boost (24%), and enjoyment of taste (18%). Seasonal spikes in consumption occur during summer, the Tet holiday, and rainy months—periods characterized by higher temperatures, festivities, and increased indoor activities.

The study also reveals a significant rise in multi-pack purchases (+58%) and online delivery orders (+24%), illustrating shifting shopping behaviors toward bulk buying for sharing or home consumption, and the growing importance of e-commerce channels.

3. Packaging and Format Preferences

Packaging remains a critical driver of consumer choice. PET bottles are the most popular packaging type overall, favored by 58% of consumers for their convenience and portability. For carbonated soft drinks, cans dominate with 62% share, benefiting from their perceived freshness and suitability for premium positioning.

Glass bottles, preferred by 74% of consumers for premium occasions, represent an important segment catering to consumers seeking luxury or nostalgic experiences.

In terms of size, small formats (250–350ml) are preferred for individual convenience and portability, while larger multi-packs (1L and above) are favored for home consumption and social sharing. This dual preference underscores the diversity in consumption occasions and the need for flexible product offerings.

4. Brand Dynamics: Global Giants vs. Local Challengers

The Vietnamese beverage landscape presents a competitive environment where global brands and local players coexist and compete for market share.

- In carbonated soft drinks, Coca-Cola and Pepsi maintain leadership in both brand awareness and consumer usage.

- In the energy drink segment, local brand Sting has overtaken international competitor Red Bull in usage (58% vs. 45%), highlighting the strength and appeal of domestic brands.

- For RTD tea, C2 dominates with 62% market share, while Tea+ has emerged as the fastest-growing brand (+18%), leveraging a health-focused, low-sugar positioning to attract health-conscious consumers.

Brand loyalty varies across categories: highest in carbonated soft drinks (65%) and lowest in sports drinks (42%), suggesting that the latter market is more fluid and open to innovation.

5. Emerging Trends: Health, Natural Ingredients, and Localization

Modern Vietnamese consumers are increasingly health-conscious and discerning. The top purchase drivers are taste (92%), value for money (78%), and the refreshing effect (65%). However, high sugar content (82%), expensive pricing (74%), and artificial ingredients (68%) remain significant barriers to purchase.

There is a strong and growing demand for beverages that are low or zero sugar (85%), offer functional health benefits (78%), and use sustainable packaging (45%). This reflects global trends toward wellness, clean labels, and environmental responsibility.

Notably, 68% of consumers express interest in local fruit flavors such as lychee, calamansi, and pineapple, pointing to a rising preference for culturally authentic, locally inspired beverage profiles.

6. Clear Consumer Segments

The market can be segmented into four distinct groups, each with unique needs and preferences:

- Value Seekers (32%): Highly price-sensitive and loyal to affordable local brands like C2 and Number 1. They prioritize cost-effectiveness without compromising taste.

- Health-Conscious Consumers (28%): Actively avoid sugar and artificial ingredients. They prefer products such as Tea+, Coca-Cola Zero, and Revive, emphasizing wellness and clean-label ingredients.

- Functional Benefit Seekers (24%): Interested in energy and sports drinks like Sting and Red Bull, driven by performance and endurance needs.

- Social Experiencers (16%): Trend-driven, premium-oriented consumers who are active on social media. They prefer RTD coffee and premium carbonated soft drinks, valuing innovation, status, and new experiences.

7. Strategic Recommendations for Beverage Companies

Given the evolving market dynamics, beverage companies operating in Vietnam should consider the following strategies:

Prioritize Health-Focused Innovation

Develop and promote products with reduced or zero sugar content and natural formulations across all beverage categories. This will directly address the growing health concerns and regulatory pressures and appeal to the expanding health-conscious consumer segment.

Target High-Growth Segments

Focus marketing and product development efforts on Health-Conscious and Functional Benefit Seekers. Creating natural functional drinks that combine health benefits with energy/performance advantages can effectively serve both groups.

Invest in RTD Coffee and Sports Drinks

Capitalize on the fastest-growing categories by expanding premium product offerings and innovative packaging. RTD coffee (+18% growth) and sports drinks (+12%) offer attractive opportunities for portfolio diversification and margin enhancement.

Optimize Digital and E-Commerce Channels

Engage the 68% of consumers who research beverages online and the 45% who purchase via e-commerce platforms. Building a strong online presence, leveraging social media marketing, and ensuring efficient delivery logistics will be critical to capture this digital-savvy audience.

Leverage Local Flavor Preferences

Develop uniquely Vietnamese flavor profiles and promote culturally authentic beverages. With 68% of consumers interested in local fruit flavors, tapping into this trend can differentiate brands and deepen emotional connections with consumers.

Conclusion

Vietnam’s refreshment beverage market stands at a pivotal crossroads marked by rapid growth and evolving consumer demands. The convergence of rising health awareness, shifting lifestyle habits, and digital consumption trends is reshaping the market landscape. Traditional products like carbonated soft drinks continue to maintain a stronghold, while fast-growing categories such as RTD tea, coffee, and functional drinks present new growth avenues.

Brands that successfully innovate health-focused products, cater to distinct consumer segments, embrace digital transformation, and celebrate cultural authenticity will gain a significant competitive advantage. Moreover, responding proactively to concerns about sugar content, artificial ingredients, and sustainability will not only meet consumer expectations but also build long-term brand loyalty.

In the years ahead, Vietnam’s beverage market will reward those who understand its complex consumer landscape, innovate thoughtfully, and build meaningful connections with local tastes and values. For both global giants and local challengers, the opportunity is vast — the market is ready to welcome the next generation of beverages that align with the evolving needs of Vietnamese consumers.

Credit Research Owner:

Mr. Pham Anh Tuan – Research Director & Country Manager, InsightAsia Vietnam

Download Link:

Click here to download the full report (PDF)

![[RECAP] BLUESEED GROUP & OPTIMIND AI: A STRATEGIC ALLIANCE DEFINING THE FUTURE OF BRANDING IN THE AI ERA](https://blueseed.group/wp-content/uploads/2025/11/hello-758x520.png)